Loading

Get Irs 1040 - Schedule Lep 2021-2025

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 1040 - Schedule LEP online

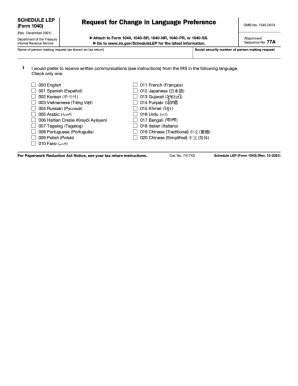

The IRS 1040 - Schedule LEP is an essential document for individuals who need to report limited English proficiency for tax purposes. This guide will provide you with comprehensive, step-by-step instructions to ensure you complete the form accurately and efficiently online.

Follow the steps to complete the IRS 1040 - Schedule LEP online

- Click ‘Get Form’ button to access the IRS 1040 - Schedule LEP and open it in your preferred tool.

- Review the title and purpose of the form to understand its function related to your tax filing. Ensure you have all relevant information, such as your personal identification and tax details.

- Begin with your name and Social Security number in the designated fields at the top of the form. Make sure to enter this information clearly to avoid potential processing delays.

- In the section where you indicate your limited English proficiency status, select the appropriate option that best represents your situation. Be accurate to ensure compliance with IRS guidelines.

- Provide any additional information requested regarding income or tax circumstances that may be relevant to your limited English proficiency.

- If applicable, review the language services information to see if you qualify for any assistance based on your proficiency status.

- Double-check all entered information for accuracy and completeness. Make corrections as necessary.

- Save your changes, and then you can download, print, or share the filled-out IRS 1040 - Schedule LEP form as needed.

Complete your tax documents online today for a streamlined filing experience.

To truly calculate the net rental income and expense from each rental property owned we start with the gross revenue and the subtract the total expenses – then we add back anything relating to the actual mortgage as well as “paper losses”.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.