Get Fha Refinance Comparison Matrix Form 2013-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the Fha Refinance Comparison Matrix Form online

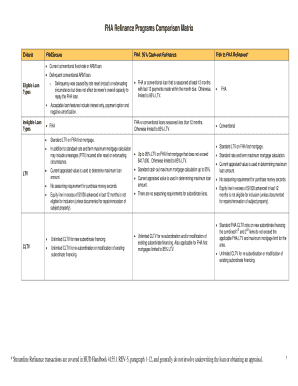

The Fha Refinance Comparison Matrix Form is a crucial document for users seeking to understand various refinancing options available through the Federal Housing Administration. This guide will help you navigate and complete the form online, ensuring that you provide the required information accurately and efficiently.

Follow the steps to successfully fill out the Fha Refinance Comparison Matrix Form.

- Click the ‘Get Form’ button to access the Fha Refinance Comparison Matrix Form and open it in your preferred electronic editor.

- Begin by entering your personal details. This typically includes your name, contact information, and the property address involved in the refinancing process.

- Next, move to the section detailing the current mortgage. Here, input information such as the existing loan amount, interest rate, and type of loan. This information is essential for making accurate comparisons.

- After that, fill in the proposed refinance details. Include the new loan amount, potential interest rate, and any proposed closing costs. Make sure to be as precise as possible to facilitate accurate comparisons.

- Review all entries thoroughly. Double-check for any errors or omissions that could affect the refinancing options presented.

- Once you have confirmed that all information is accurate, save your changes. You may also choose to download, print, or share the completed form as needed.

Start filling out the Fha Refinance Comparison Matrix Form online to explore your refinancing options today.

Yes, the FHA does allow co-borrowers on refinance loans. This provides an opportunity for friends, family, or partners to join in the ownership and enhance qualifying potential. When you utilize the Fha Refinance Comparison Matrix Form, it becomes easier to understand the advantages of including co-borrowers in your application, such as increased buying power and better rates.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.