Loading

Get Irs 941 2022

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 941 online

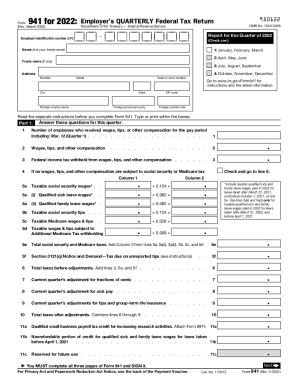

The IRS 941 form, known as the Employer’s Quarterly Federal Tax Return, is crucial for employers to report employment taxes. This guide will help you fill out the IRS 941 online by providing clear, step-by-step instructions that are easy to follow, regardless of your experience level.

Follow the steps to complete your IRS 941 online effectively.

- Press the ‘Get Form’ button to access the IRS 941 form and open it in your selected editor.

- Enter your employer identification number (EIN) in the designated field. This number identifies your business to the IRS.

- In the name field, enter your legal name (not your trade name). Fill out the trade name if applicable.

- Provide your business address, including the street, city, state, and zip code. If you operate in a foreign country, you can enter the necessary details for the foreign address.

- Answer the questions in Part 1 regarding your employees, their wages, and compensation for the quarter. Include the total number of employees who received payment.

- Report wages, tips, and other compensation in the appropriate lines as instructed, ensuring accuracy for proper tax calculation.

- Detail federal income tax withheld from the reported wages in the specified line.

- Complete the sections regarding social security and Medicare wages, providing necessary tax information in the respective lines.

- Review applicable adjustments related to fractions of cents, sick pay, and any adjustments for tips or insurance.

- Calculate the total taxes owed before adjustments and enter that amount accurately.

- Identify any nonrefundable credits applicable to your business, completing those sections to reduce your total tax liability.

- After reviewing and ensuring all entries are correct, proceed to sign the form. Make sure that all three pages of Form 941 are completed.

- Save your changes and choose to download, print, or share the completed form as necessary.

Start completing your IRS 941 form online today to stay compliant with federal tax regulations.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Employers use Form 941, Employer's Quarterly Federal Tax Return, to report income taxes, Social Security tax or Medicare tax withheld from employees' paychecks and to pay their portion of Social Security or Medicare tax. In the end, the information on your quarterly 941s must match your submitted Form W-2s.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.