Loading

Get Me Rew-3 2022-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the ME REW-3 online

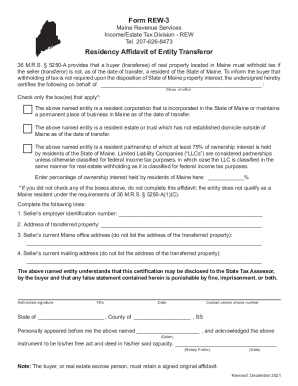

The ME REW-3 is an important form required by Maine Revenue Services for the declaration of residency status of the transferor in real estate transactions. This guide will provide you with step-by-step instructions to help you complete the form accurately and efficiently.

Follow the steps to complete the ME REW-3 online.

- Press the ‘Get Form’ button to access the ME REW-3 form and open it in an appropriate editor.

- In the section with the buyer's details, enter the name of the seller as it appears on the property documents.

- Select the applicable box or boxes that describe the residency status of the seller, ensuring you choose the correct option reflecting your situation.

- If the seller is a partnership, enter the percentage of ownership interest held by residents of Maine in the specified field.

- Fill in the seller's employer identification number in the designated space.

- Provide the address of the transferred property in the appropriate section.

- Input the seller’s current Maine office address, ensuring it is not the address of the transferred property.

- Enter the seller’s current mailing address, which should also not include the address of the transferred property.

- Ensure you understand the certification's implications, including the possibility of disclosure to the State Tax Assessor and potential penalties for false statements.

- Authorize the form by signing in the designated area, adding your title and the date.

- Provide the contact person's phone number for any follow-up inquiries related to the transaction.

- If applicable, arrange for the form to be notarized by a Notary Public, who will acknowledge the signer's capacity.

- Once all fields are filled, review the information for accuracy, and then save your changes, download, or print the completed form.

Complete your ME REW-3 form online today to ensure a smooth real estate transaction.

Maine Capital Gains Tax Maine taxes both long- and short-term capital gains at the full income tax rates described in the income tax section above. This means that income from capital gains can face a state rate of up to 7.15% in Maine.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.