Loading

Get Ote:* N Due To Issues Displaying The ... - State Of Iowa Taxes

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the OTE:* N Due To Issues Displaying The ... - State Of Iowa Taxes online

Filling out the OTE:* N Due To Issues Displaying The ... form for Iowa Taxes can be straightforward when you follow the right guidance. This guide provides step-by-step instructions to ensure you accurately complete the form required for the reissuance of warrants.

Follow the steps to successfully complete the form.

- Click ‘Get Form’ button to obtain the form and open it in your preferred editor.

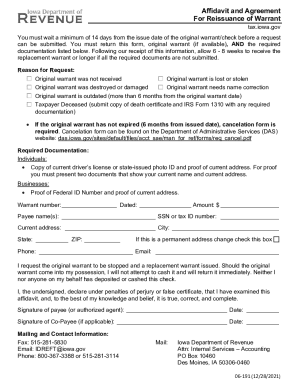

- In the ‘Reason for Request’ section, select the applicable reason by checking the corresponding box. This could include options such as ‘Original warrant was not received’ or ‘Original warrant is lost or stolen’.

- Complete the ‘Warrant number’ field by entering the specific warrant number in the provided space. Ensure this is correct to avoid any processing delays.

- Fill in the ‘Dated’ and ‘Amount’ fields accurately. The date should reflect when the original warrant was issued, and the amount should match the original check.

- Enter the payee name(s) and their social security number or tax ID number in the designated areas. This information is crucial for the proper identification of beneficiaries.

- Provide the current address, including the city, state, and ZIP code. If this is a permanent address change, be sure to check the box provided.

- Include your phone number and email address for any necessary follow-up communication. Ensure these are current to avoid missing any updates.

- Read the declaration statement carefully, then provide your signature (or that of an authorized agent) and the date in the indicated areas. If there's a co-payee, they should also sign and date the form.

- After completing all sections, review the form for accuracy and completeness. Once confirmed, you can save changes, download it, print, or share the form as needed.

Complete your document online today to facilitate the swift reissuance of your warrant.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

The state is gradually on its way to a flat tax. In 2023, Iowa's top individual income tax rate drops from 8% to 6%. That gives a tax cut to Iowans making $75,000 or more when they file taxes next year. Then by 2026, the top tax rate will fall to 3.9%, the same flat tax rate for all taxpayers.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.