Loading

Get Ky 765 Schedule K-1 2019-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the KY 765 Schedule K-1 online

Filling out the KY 765 Schedule K-1 online can seem daunting, but understanding the form's components and instructions can simplify the process. This guide provides clear, step-by-step instructions tailored to assist users of all experience levels.

Follow the steps to complete your KY 765 Schedule K-1 online.

- Click the 'Get Form' button to obtain the KY 765 Schedule K-1 form and open it in your browser's editor.

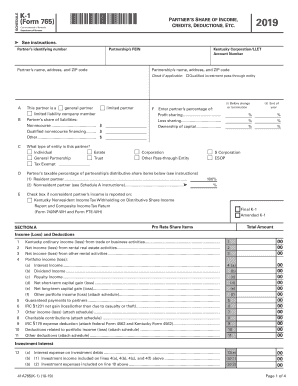

- Begin by filling in the partner’s identifying number and the partnership’s Federal Employer Identification Number (FEIN) in the designated fields.

- Enter the partner's name, address, and ZIP code, followed by the partnership’s name, address, and ZIP code in the appropriate sections.

- Check the box if the partnership is a qualified investment pass-through entity and indicate the type of partner: general partner, limited partner, or limited liability company member.

- Fill in the partner’s share of liabilities, including nonrecourse, qualified nonrecourse financing, and other categories as applicable.

- Specify the type of entity for the partner, such as individual, estate, or trust, and enter the partner’s percentage of profit sharing, loss sharing, and ownership of capital.

- Complete the partner’s taxable percentage of the partnership’s distributive share items and indicate if the partner is a resident or nonresident.

- Proceed to fill out each relevant section for income (loss), deductions, and other items as listed, ensuring to attach any necessary schedules.

- Check any applicable boxes for nonresident partners and indicate if the K-1 is final or amended.

- Once you have reviewed and completed all sections of the form, save your changes, download, print, or share the completed KY 765 Schedule K-1 as required.

Complete your documents online to facilitate efficient tax reporting.

Purpose of Schedule K-1 The partnership uses Schedule K-1 to report your share of the partnership's income, deductions, credits, etc. Keep it for your records. Don't file it with your tax return unless you are specifically required to do so.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.