Loading

Get Mi Mi-1040 2021

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MI MI-1040 online

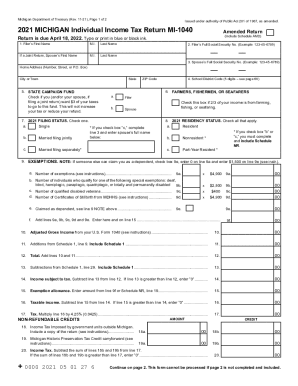

Filling out the MI MI-1040 form online can streamline the process of submitting your individual income tax return. This guide provides clear, step-by-step instructions to assist you with completing each section of the form, ensuring a smooth filing experience.

Follow the steps to successfully fill out the MI MI-1040 online.

- Click the ‘Get Form’ button to access the MI MI-1040 form and open it in your preferred editor.

- Provide your and your spouse's names in the designated fields. If filing jointly, include both first names, middle initials (if applicable), and last names.

- Enter your Social Security number and your spouse’s Social Security number in the specified fields.

- Fill in your home address, including the street number and name, city or town, state, and ZIP code.

- Indicate if you want $3 of your taxes to go to the State Campaign Fund by checking the relevant box. This does not affect your refund or total tax liability.

- For farmers, fishermen, or seafarers, check the box if you earn at least two-thirds of your income from these sources.

- Select your filing status by checking the appropriate box: Single, Married filing jointly, or Married filing separately.

- Choose your residency status by checking all relevant options: Resident, Nonresident, or Part-Year Resident.

- Complete the exemptions section by entering the relevant numbers, ensuring to follow the special instructions regarding dependents.

- Input your Adjusted Gross Income from your U.S. Form 1040 and any additions or subtractions as required.

- Calculate your total income subject to tax and your tax liability, ensuring to adhere to the calculation methods outlined in the form.

- Fill in the information regarding non-refundable credits, refundable credits, and payments, ensuring to include the appropriate forms where required.

- Determine if you owe taxes or if you are due a refund by comparing the total tax liability to the total credits and payments.

- Complete the direct deposit information if opting for a direct deposit refund, including the routing number, account number, and account type.

- Review all entered information for accuracy before saving your changes, downloading, printing, or sharing the completed form.

Complete your MI MI-1040 online today for a timely and efficient tax filing experience.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.