Loading

Get Nd Form Nd-1ext 2021

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the ND Form ND-1EXT online

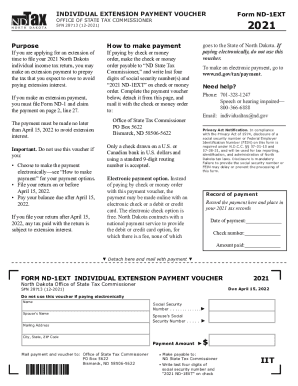

Filling out the ND Form ND-1EXT online is a straightforward process that allows you to apply for an extension of time to file your North Dakota individual income tax return. This guide provides clear instructions to help you successfully complete the form.

Follow the steps to fill out ND Form ND-1EXT online.

- Click 'Get Form' button to obtain the form and open it in the editor.

- Enter your name in the designated field. This should be your full legal name as it appears on your tax documents.

- If applicable, provide your partner's name in the next field. Ensure it is correctly spelled and follows the same legal format.

- Fill in your mailing address, including street address, city, state, and ZIP code. Double-check for accuracy to avoid delays.

- Input your Social Security Number in the appropriate field, ensuring that you enter all digits correctly.

- If you have a partner, you will also need to enter their Social Security Number in the specified area.

- Next, indicate the payment amount you intend to submit. Be sure this amount reflects any prepayment of taxes owed.

- Review all entered information for completeness and accuracy. Make any necessary adjustments before finalizing your submission.

- After confirming all details, save the changes in your document. Then, you may choose to download, print, or share the completed form as needed.

Complete your ND Form ND-1EXT online today to ensure timely processing of your tax extension.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

You don't need to file a separate state extension form and you don't need to notify the Office of State Tax Commissioner that you received a federal extension. When filing your North Dakota return, you have the option to request an extension on the form or in your tax software.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.