Loading

Get Nj Cbt-100 Instructions 2021

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NJ CBT-100 Instructions online

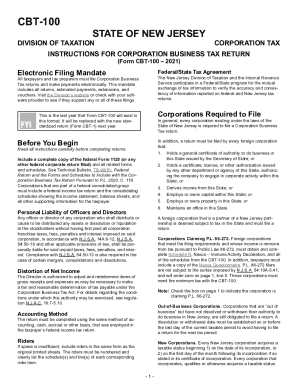

Filing the NJ CBT-100 tax return is essential for corporations operating in New Jersey. This guide provides step-by-step instructions to help you complete the form effortlessly using the online filing option, ensuring compliance with state tax regulations.

Follow the steps to complete the NJ CBT-100 form online.

- Click 'Get Form' button to obtain the form and open it in the editor.

- Fill in your corporation's federal employer identification number, New Jersey corporation number, and complete address in the designated fields.

- Indicate whether this is the initial return or an amended return by checking the appropriate box.

- Complete the Annual General Questionnaire and Schedules A (Parts I, II, and III), A-2, A-3, A-4, and J as required for your corporation type.

- Enter your business activity code based on the information from your federal tax return.

- Calculate your taxable net income by following the instructions for Schedule A and input the relevant amounts in the designated lines.

- Complete any applicable schedules, ensuring you check any boxes indicating special circumstances relevant to your corporation.

- Once all sections are filled out accurately, review your entries for any errors or omissions.

- Save your changes, then download or print the completed form for your records.

- Submit your completed NJ CBT-100 form electronically to ensure compliance with the electronic filing mandate.

Complete your NJ CBT-100 form online today to avoid penalties and ensure timely submission.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

You can request it by calling the toll-free number on your IRS notice, or your tax professional can call the dedicated tax pro hotline or compliance unit (if applicable) to request FTA for any penalty amount. Learn more about how to handle IRS penalties, or get help from a trusted IRS expert.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.