Loading

Get Irs 990-t 2021-2025

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 990-T online

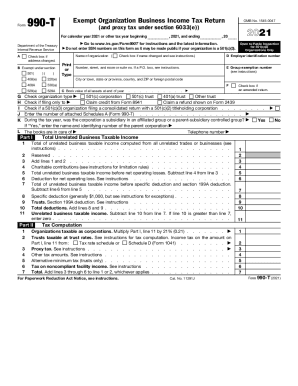

The IRS 990-T is an important form for exempt organizations to report unrelated business income. This guide provides clear, step-by-step instructions to help users complete the form online efficiently.

Follow the steps to successfully fill out the IRS 990-T online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter the name of the organization in the appropriate field. Ensure accuracy, as this information needs to match the organization’s records.

- Fill in the Employer Identification Number (EIN) in part D. This is essential for the IRS to identify the organization accurately.

- Provide the organization’s address and check the box if there has been a change in the address. Enter the city, state, and postal code.

- Indicate whether the organization is claiming a credit or refund from prior forms, marking the relevant boxes if so.

- In Part I, input total unrelated business taxable income. This is crucial for calculating the tax owed.

- Complete the deductions section, including any specific deductions applicable to the organization.

- Proceed to Part II to compute the tax based on total unrelated business taxable income. Apply the correct rate as instructed.

- In Part III, provide information on any credits the organization is eligible to claim.

- Finish the form by signing and dating it. Ensure that the individual signing is authorized to do so.

- Finally, users can save changes, download the form, print, or share it as necessary.

Complete your IRS 990-T form online today to ensure compliance and accuracy.

Related links form

An exempt organization that has $1,000 or more of gross income from an unrelated business must file Form 990-TPDF. An organization must pay estimated tax if it expects its tax for the year to be $500 or more.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.