Loading

Get Co Dor Dr0021 Booklet 2021-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CO DoR DR0021 Booklet online

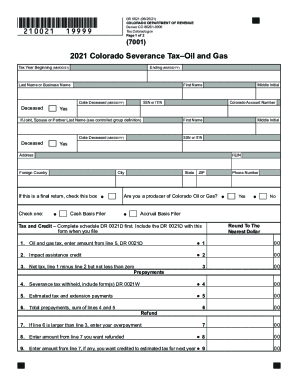

Filling out the CO DoR DR0021 Booklet is essential for reporting severance tax obligations related to oil and gas production in Colorado. This guide provides clear, step-by-step instructions on completing each section of the form online, ensuring a smooth filing process.

Follow the steps to complete your DR0021 form online.

- Press the ‘Get Form’ button to access the DR0021, then open it in your preferred document editing tool.

- Begin by entering your personal or business information, including your name, Social Security number or ITIN, and Colorado Account Number in the designated fields. If applicable, provide your spouse or partner's information as well.

- Select your accounting method, indicating whether you are a cash basis or accrual basis filer. This is important for accurately reporting income and expenses.

- Complete the sections regarding tax and credits. First, calculate your oil and gas severance tax using the appropriate schedule (DR0021D) and enter the value on line 1 of the DR0021 form.

- Include any severance tax withheld from your income, collecting the amounts from your DR0021W forms. Enter the total on line 4 for prepayments.

- If applicable, enter any estimated tax and extension payments made during the taxable year on line 5.

- Calculate your total prepayments by adding the values from lines 4 and 5, then enter that total on line 6.

- Determine if you have an overpayment by comparing line 6 with line 3. If line 6 is greater, enter the overpayment amount on line 7.

- Complete any additional sections, such as interest or penalties, as required by your specific situation.

- Before finalizing, ensure all information is accurate and complete, sign the document, and make any necessary payments. You can save changes, download, print, or share the completed form as needed.

Start completing your CO DoR DR0021 Booklet online today to stay compliant with severance tax regulations.

As a primary approach, states have imposed taxes and fees on the extraction, production and sale of natural gas and oil. These “severance” taxes—taxes applied to materials severed from the ground—tax the extraction or production of oil, gas and other natural resources.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.