Loading

Get Il Dor Schedule 1299-c 2021

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IL DoR Schedule 1299-C online

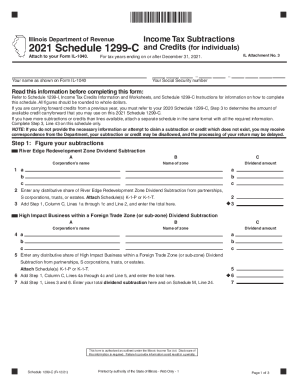

The IL DoR Schedule 1299-C is an essential form for individuals seeking to claim income tax subtractions and credits in Illinois. This guide provides clear, step-by-step instructions for completing the form online, ensuring all users can easily navigate the process.

Follow the steps to complete the IL DoR Schedule 1299-C online

- Click the ‘Get Form’ button to access the IL DoR Schedule 1299-C. Open the form in your preferred editor to proceed with filling it out.

- Begin with Step 1, where you will figure your subtractions. Input your Social Security number and your name as shown on Form IL-1040. Gather the necessary information about any River Edge Redevelopment Zone Dividends, including the names of corporations and zones as applicable.

- Continue filling out the dividend subtractions for High Impact Businesses within Foreign Trade Zones. Similar to Step 1, include all required company and zone information to ensure accurate calculations.

- Move to Step 2 if you earned any income tax credits during the current tax year. Follow the specified worksheets for Research and Development, K-12 Instructional Materials and Supplies, and Adoption credits, entering pertinent details for each section.

- In Step 3, figure your overall income tax credits. Start by entering your income tax from Form IL-1040, and sum any credit amounts before completing the necessary calculations to determine your credit eligibility.

- Review and confirm all entries for accuracy before proceeding to save your changes. Once confirmed, download, print, or share your completed IL DoR Schedule 1299-C for submission.

Complete your IL DoR Schedule 1299-C online today to ensure accurate reporting and maximize your tax benefits.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

To file online, use a tax professional or tax preparation software. All you need is a valid Illinois driver's license number or an Illinois identification card number. If you do not use one of these methods, you can download the tax return from our website and file a paper return.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.