Loading

Get Hi Dot A-6 2021-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the HI DoT A-6 online

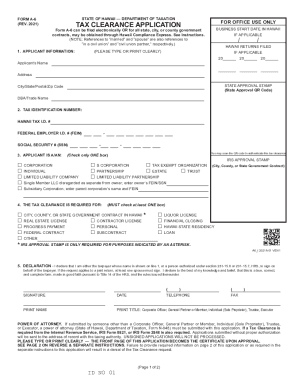

The HI DoT A-6 form, used for tax clearance applications in Hawaii, can be filled out online to facilitate your business dealings with state, city, or county contracts. This guide provides you with comprehensive step-by-step instructions for completing this important document accurately and efficiently.

Follow the steps to successfully complete your tax clearance application.

- Click the ‘Get Form’ button to obtain the HI DoT A-6 document and open it in the appropriate editor.

- Enter the applicant information in Section 1. This includes the applicant's name, address, and DBA (doing business as) or trade name if applicable.

- In Section 2, provide the required tax identification numbers, including your Hawaii Tax I.D. number, federal employer I.D. (FEIN), and social security number if necessary.

- For Section 3, check the appropriate box to indicate the type of applicant you are — whether you are a corporation, individual, partnership, or other type listed.

- In Section 4, indicate the purpose for which the tax clearance is required by checking at least one box. Options range from city or state contracts to liquor and loan licenses.

- Complete Section 5 by signing and dating the form. Ensure the printed name and title are included, and provide a contact telephone number.

- If applicable, continue to Section 6 and fill in the details related to any government contracts.

- For liquor or contractor licensing, complete Sections 7 and 8 respectively, marking the relevant options.

- Fill out Section 9 with the date of your arrival or return to Hawaii if you are applying for residency clearance.

- Complete any additional fields in Section 10 through 13 that relate to your organization's specific situation, providing thorough descriptions and answering the required yes/no questions.

- Once all sections are complete, review the entire form for accuracy. You can save changes, download, print, or share the completed form as needed.

Start filling out the HI DoT A-6 online today for your tax clearance needs.

How much is collected under the HARPTA law? The amount collected under the HARPTA law is 7.25% of the sales price. What is the actual Hawaii capital gains tax? The Hawaii capital gains tax on real estate is 7.25% of the gain plus depreciation.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.