Loading

Get Emergencies - Sc Department Of Revenue

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Emergencies - SC Department Of Revenue online

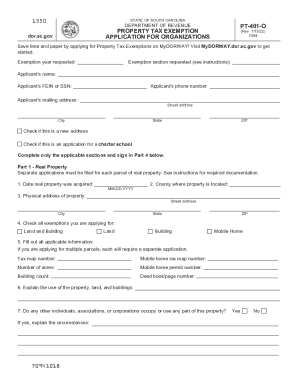

This guide provides a detailed walkthrough for completing the Emergencies form from the SC Department of Revenue. This process will help ensure that your application for property tax exemptions is submitted accurately and efficiently.

Follow the steps to fill out the Emergencies form online.

- Click the ‘Get Form’ button to access the form and open it in the online editor.

- Begin by filling out the exemption year requested and the section you are applying for, as indicated at the beginning of the form.

- Enter the applicant's name, FEIN or SSN, phone number, and mailing address, ensuring all information is accurate.

- Indicate if the application is for a new address or a charter school by checking the appropriate boxes.

- Proceed to Part 1 - Real Property: Provide the date the real property was acquired, the county where the property is located, and the physical address of the property.

- Check all exemptions you are applying for, such as land and building, land only, building only, or mobile home.

- Complete all necessary fields regarding multiple parcels, including tax map numbers and number of acres.

- Explain the intended use of the property and whether others occupy or use any part of it, providing details if applicable.

- Answer questions regarding rental income and leases related to the property, providing detailed information as needed.

- For Part 2 - Personal Property, list vehicle exemption details, including Vehicle Identification Number, make, year, and registration details.

- If applicable, detail items related to furniture, fixtures, and equipment requiring exemption and their usage.

- In Part 3, provide details on any real or personal property to be removed, including necessary identifiers like tax map numbers or Vehicle Identification Numbers.

- Complete Part 4 by signing and dating the declaration, confirming the correctness of the information provided.

- Once all information is completed, save your changes, and download or print the form for submission.

Complete your application online today to streamline the process.

Individual Income Tax rates range from 0% to a top rate of 7% on taxable income for tax years 2021 and prior and from 0% to a top rate of 6.5% on taxable income for tax year 2022. Tax brackets are adjusted annually for inflation.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.