Loading

Get Md Comptroller 502 2021-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MD Comptroller 502 online

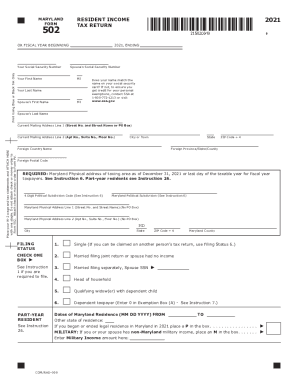

This guide provides a clear and supportive walkthrough on completing the MD Comptroller 502, the Maryland Resident Income Tax Return. By following these steps, users can efficiently fill out the form online and ensure accurate submission.

Follow the steps to complete the MD Comptroller 502 online.

- Press the ‘Get Form’ button to access the MD Comptroller 502 document and open it in your editing interface.

- Enter your first name, last name, and Social Security number in the designated fields. Ensure that the name matches your Social Security card to avoid issues with your exemptions.

- Input your current mailing address, ensuring to include your city, state, and ZIP code. If necessary, provide additional address information on the following line.

- Fill out the Maryland physical address where you were located as of December 31 for the tax year. This includes your street address and county.

- Select your filing status by checking the appropriate box among the options provided. This includes options for single, married filing jointly, married filing separately, head of household, and qualifying widow(er).

- If applicable, indicate any part-year residency dates and provide information about any non-Maryland military income.

- In the exemptions section, check the boxes that apply to you and your spouse, including any dependents. Remember to attach the Dependents' Information Form 502B if claiming dependents.

- Report your income as detailed, including wages, taxable pensions, and any other income sources. Be sure to follow the instructions for any adjustments or additions to your reported income.

- Calculate your deductions by selecting either the standard deduction method or the itemized deduction method. Complete the necessary lines based on your choice.

- Finalize your form by reviewing all entries, calculating total payments or refunds, and ensuring your contact information is correct for any direct deposits.

- Once you have completed all necessary fields, save your changes, download the form, and if needed, print or share it before submission.

Complete your tax documents online for efficiency and accuracy.

Place Form PV with attached check/money order on TOP of Form 502 and mail to: Comptroller of Maryland Payment Processing PO Box 8888 Annapolis, MD 21401-8888 DIRECT DEPOSIT OF REFUND (See Instruction 22.)

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.