Loading

Get Pdf 2016 Form 3803 -- Parents' Election To Report Child's Interest And ...

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the PDF 2016 Form 3803 -- Parents' Election To Report Child's Interest And Dividends online

This guide provides clear, step-by-step instructions to help you complete the PDF 2016 Form 3803, which enables parents to report their child's interest and dividends. Filling out this form online ensures accuracy and efficiency in your tax filing process.

Follow the steps to successfully complete the form.

- Click ‘Get Form’ button to obtain the form and open it in your preferred online PDF editor.

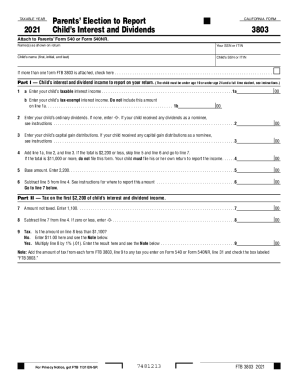

- Begin by entering your name(s) as shown on your tax return, followed by your Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN).

- In the next section, input your child's name, including their first name, initial, and last name, as well as their SSN or ITIN.

- If you have more than one Form FTB 3803 to submit, check the appropriate box indicated on the form.

- Proceed to Part I, where you'll report your child's interest and dividend income. Start with line 1a, entering the taxable interest income your child earned.

- On line 1b, enter the child’s tax-exempt interest income, ensuring not to include this amount in line 1a.

- Complete line 2 by entering your child’s ordinary dividends. If none, enter -0-.

- For line 3, enter any capital gain distributions received by your child. If they received distributions as a nominee, refer to the provided instructions.

- Add the amounts from lines 1a, 2, and 3 and input the total on line 4. If $2,200 or less, skip lines 5 and 6; if $11,000 or more, your child must file their own return.

- If the total from line 4 is $2,200 or less, enter 2,200 on line 5 for the base amount.

- On line 6, subtract line 5 from line 4 and continue accordingly.

- In Part II, start with line 7, where you will enter the amount not taxed, which is 1,100.

- For line 8, subtract line 7 from line 4, entering -0- if the result is zero or less.

- On line 9, determine whether the amount on line 8 is less than 1,100. If yes, multiply by 1%; otherwise, enter $11.00.

- Finally, review your entries for accuracy, save your changes, download, print, or share the completed form as needed.

Start completing your documents online today to ensure an efficient filing process.

Unearned income from interest, dividends, and capital gains are taxed in tiers defined by the IRS. For a child with no earned income, the amount of unearned income up to $1,250 is not taxed in 2023. The next $1,250 is taxed at the child's rate. Any amount above $2,500 is taxed at the parents' rate.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.