Loading

Get Ca Ftb 100_dsa

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CA FTB 100_DSA online

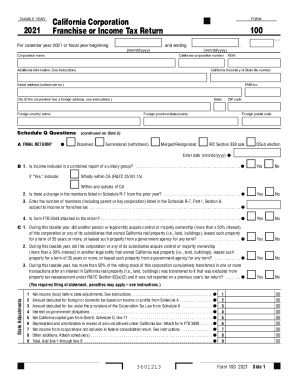

This guide provides comprehensive instructions on filling out the California Franchise Tax Board Form 100_DSA for the taxable year 2021. Users can navigate the form online with ease using these step-by-step guidelines tailored to meet various experience levels.

Follow the steps to successfully complete the CA FTB 100_DSA.

- Click the ‘Get Form’ button to obtain the form and open it in your editor.

- Enter your taxable year at the top of the form. Ensure you accurately align with either the calendar year or the specific fiscal year you are reporting.

- Fill in the corporation name and California corporation number. These are crucial for identifying your business accurately.

- Complete the Federal Employer Identification Number (FEIN) and California Secretary of State file number. These identifiers are necessary for tax purposes.

- Provide the street address, including suite or room number, city, state, and ZIP code. For foreign addresses, ensure the foreign country and other relevant details are filled out.

- Move on to Schedule Q questions. Indicate if the return is final, if you have dissolved or merged the corporation, and answer other queries accurately based on your situation.

- Complete the sections on state adjustments. Report items like net income before adjustments and any deductions you are claiming.

- Proceed to fill out the income and tax sections. You will need to report total income and calculate the applicable taxes based on your state-specific calculations.

- Review the completed sections for accuracy, and make any necessary corrections. It’s essential that all information is accurate to avoid processing delays.

- Once all fields are filled out, you have the option to save your changes, download a copy for your records, print the form, or share it as needed.

Complete your tax documents online using these guidelines to ensure compliance and accuracy.

Understanding Your State Income Taxes The Franchise Tax Board (FTB) is the agency responsible for collecting state personal income taxes in California.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.