Loading

Get Ny Tc Tc208 2022-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NY TC TC208 online

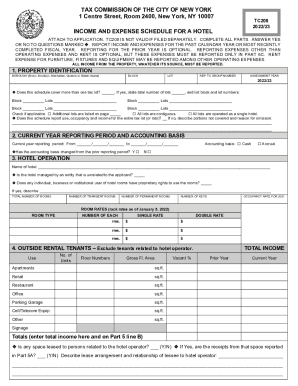

The NY TC TC208 form is essential for reporting the income and expenses of a hotel for tax purposes. Completing this form accurately is crucial to maintain compliance and ensure optimal tax outcomes.

Follow the steps to complete the NY TC TC208 form.

- Click 'Get Form' button to obtain the form and open it for editing.

- Begin with the property identification section. Fill in details such as borough, block, and lot numbers. If your schedule covers multiple tax lots, indicate the total number and provide the respective block and lot numbers.

- In the current year reporting period section, specify the timeframe for which you are reporting income and expenses. Indicate whether you have changed the accounting basis from the prior period, selecting either cash or accrual.

- Fill out the hotel operation section by providing the name of the hotel. Answer questions regarding management and proprietary rights to hotel rooms.

- Detail the total number of rooms, transient rooms, permanent rooms, and occupancy rate for the previous year in the hotel operation section. Also, list room rates for various types as of January 5, 2022.

- Input the outside rental tenants' data, including the number of units, floor numbers, gross floor area, and any vacancy percentages. Total the income from outside tenants in this section.

- Proceed to the income section, where you will tabulate departmental income from various sources such as rooms, food and beverage, and other services, as well as income from outside tenants.

- In the expenses section, categorize and total departmental expenses, undistributed operating expenses, fixed expenses, and business expenses.

- Calculate net operating income before real estate tax and subtract any real estate taxes for net income after taxes in the recapitulation section.

- Complete the furniture, fixtures, and equipment section, including reserves and costs associated with items purchased in the reporting year.

- Finally, fill out the land or building lease information, if applicable, detailing the lessor, lessee, the term of the lease, and the nature of any rent or expense arrangements.

- After all fields are completed, ensure to review the form for accuracy, then save changes, and prepare to download, print, or share your completed form.

Complete your NY TC TC208 form online to ensure accurate reporting of your hotel's income and expenses.

New York City Tax (NYC1) is a resident tax. If an employee lives in NYC and works anywhere, then the employer must withhold the NYC resident tax, which is remitted with the state income tax.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.