Get Motor Tax Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Motor Tax Form online

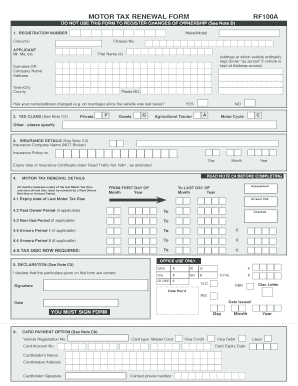

Filling out the Motor Tax Form online is a straightforward process that allows vehicle owners to renew their motor tax efficiently. This guide provides a detailed, step-by-step approach to ensure you complete the form accurately and with ease.

Follow the steps to complete your Motor Tax Form online.

- Press the ‘Get Form’ button to obtain the Motor Tax Form and open it in the editor.

- Enter your vehicle's registration number in the designated field to identify the vehicle accurately.

- Indicate the color of your vehicle in the specified section.

- Provide your details as the applicant. This includes selecting your title (e.g., Mr., Ms.), typing your first name(s), and your surname or company name.

- Fill in your address where the vehicle is ordinarily kept. If it is kept at an alternative address, enter ‘as across’.

- Include your contact phone number to facilitate communication regarding your application.

- If there has been a name or address change since the last time your vehicle was taxed, indicate this by selecting 'Yes' or 'No'.

- Select the tax class that applies to your vehicle from the provided options, ensuring you check the appropriate box.

- Enter the insurance company’s name and your insurance policy number. Also, input the expiry date for your insurance certificate.

- Complete the Motor Tax Renewal details by entering the months and years for past ownership or non-use periods if applicable.

- Sign the declaration asserting that all particulars on the form are correct.

- If applicable, complete the card payment option section with details like card type, card number, and expiration date.

- Review all entries for accuracy. Once satisfied, you can save changes, download, print, or share the completed form.

Complete your Motor Tax Form online today to ensure your vehicle remains properly taxed.

To claim a car tax credit, first confirm your vehicle qualifies for the available credits, such as the electric vehicle credit. Complete the necessary forms, including the Motor Tax Form, to document your vehicle's eligibility and associated expenses. During tax filing, include these forms with your return to ensure you receive the credit. Staying informed about changes to tax laws is crucial for maximizing your savings.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.