Loading

Get Ca Ftb 541 - Schedule K-1 2021-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CA FTB 541 - Schedule K-1 online

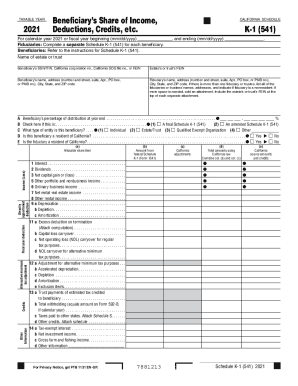

Completing the CA FTB 541 - Schedule K-1 online can streamline the process of reporting a beneficiary's share of income, deductions, and credits for trusts and estates. This guide offers clear, step-by-step instructions to help users fill out the form accurately and efficiently.

Follow the steps to complete the CA FTB 541 - Schedule K-1.

- Click ‘Get Form’ button to acquire the Schedule K-1 (541) and open it in your editor.

- Fill in the taxable year at the top of the form, ensuring it reflects the correct calendar or fiscal year information.

- Enter the name of the estate or trust along with its Federal Employer Identification Number (FEIN).

- Provide the beneficiary’s Social Security Number (SSN), Individual Taxpayer Identification Number (ITIN), California corporation number, California Secretary of State (SOS) file number, or FEIN.

- List the beneficiary’s name, full address (including street, city, state, and ZIP code).

- Complete the fiduciary's details, including their name and full address. If there are multiple fiduciaries, list each along with their details.

- Indicate the beneficiary’s percentage of distribution as of year-end, providing the appropriate percentage value.

- Select whether this is a final or amended Schedule K-1 by checking the corresponding box.

- Describe the type of entity of the beneficiary, marking the appropriate option for individual, estate/trust, qualified exempt organization, or other.

- Indicate residency status for both the beneficiary and the fiduciary, checking ‘Yes’ or ‘No’ for California residency.

- Complete the income sections by transferring amounts from federal Schedule K-1 (Form 1041) for items such as interest, dividends, capital gains, etc.

- Fill in any applicable California adjustments and combine them with federal amounts to reflect totals under California law.

- Provide additional information regarding tax credits and deductions, if applicable.

- Review all entries for accuracy before saving, downloading, or printing the completed Schedule K-1.

Start filling out your documents online for an easier filing experience.

The S corporation uses Schedule K-1 (100S) to report the shareholder's share of the S corporation's income, deductions, credits, etc. Information from the Schedule K-1 (100S) is used to complete your California tax return. Keep a copy of Schedule K-1 (100S) for your records.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.