Loading

Get Bir Form 2550m Pdf Download

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the BIR Form 2550M PDF download online

Filling out the BIR Form 2550M is an essential task for VAT-registered individuals and businesses in the Philippines. This guide provides a comprehensive and user-friendly approach to completing the form online, ensuring that you meet your tax obligations accurately and timely.

Follow the steps to fill out the BIR Form 2550M online.

- Click the ‘Get Form’ button to access the BIR Form 2550M and open it in your editing tool of choice.

- In Box No. 1, enter the transaction period for which you are filing. This refers to the month covered by the declaration, not the date of filing.

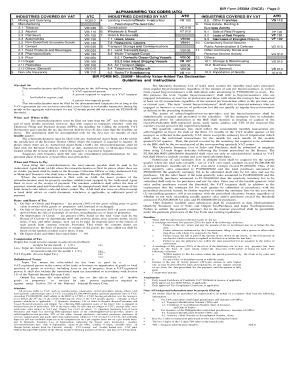

- Complete the sections on industries covered by VAT. Specify the applicable industry by marking the corresponding alphanumeric tax code (ATC). Refer to the list provided to ensure accuracy.

- Provide details regarding your output tax and input tax calculations. This is crucial for determining the total VAT payable, ensuring to follow the provided formulas.

- Fill in your taxpayer identification number (TIN) accurately. The last three digits should represent your branch code.

- Once all relevant sections have been filled out, review your entries for completeness and accuracy.

- Save the completed form and choose to either download it, print it for your records, or share it if necessary.

Start completing your BIR Form 2550M online today to ensure your VAT returns are filed on time.

BIR Form 2550M is used for reporting monthly value-added tax (VAT) liabilities and payments to the Bureau of Internal Revenue. This form is essential for businesses registered for VAT compliance. Download the form easily by using 'BIR Form 2550M PDF Download' for your bookkeeping needs.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.