Loading

Get Nyc Tc201_dsa

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NYC TC201_DSA online

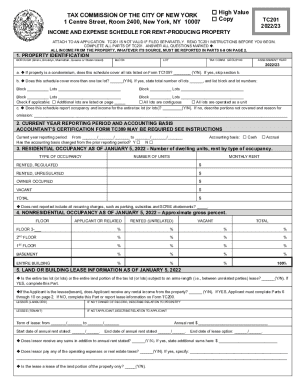

Navigating the online form TC201 for income and expense reporting for rental properties can seem complex. This guide will provide clear, step-by-step instructions tailored to meet your needs, ensuring that your submissions are accurate and complete.

Follow the steps to successfully complete the NYC TC201_DSA online.

- Press the ‘Get Form’ button to access the form and open it in your chosen online editor.

- Begin by filling out the property identification section. Specify the borough, block, lot number, and assessment year for your property.

- Indicate whether your application covers all lots associated with a condominium or if it includes multiple tax lots. Provide the necessary details as requested.

- For the current year reporting period, enter the start and end dates. Confirm whether the accounting basis used has changed from the prior year.

- List the number of residential and nonresidential units as of January 5 of the reporting year, along with the monthly rent amounts for each category.

- Fill in the expense information section by reporting all actual operating expenses and ensuring they are itemized correctly.

- Review all entries for accuracy. Once you have confirmed the information is correct, save your changes.

- Download, print, or share your completed form as needed, making sure all attachments are included.

Start completing your NYC TC201_DSA online today for a hassle-free submission.

The state as a whole has a progressive income tax that ranges from 4. % to 10.9%, depending on an employee's income level. There is also a supplemental withholding rate of 11.70% for bonuses and commissions.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.