Loading

Get Ny Dtf Nyc-202_dsa

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NY DTF NYC-202_DSA online

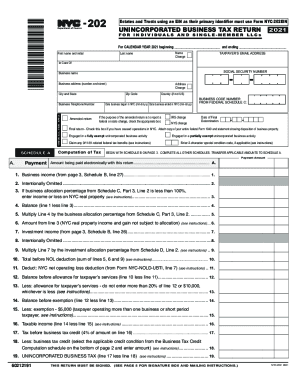

Filling out the NY DTF NYC-202_DSA form is crucial for those under the unincorporated business tax in New York City. This guide provides a clear, step-by-step approach to help you complete the form accurately and efficiently.

Follow the steps to successfully complete the NY DTF NYC-202_DSA form.

- Click ‘Get Form’ button to obtain the form and open it in your chosen editing tool.

- Enter basic information including the taxpayer's first name, last name, and email address in the designated fields.

- Provide your Social Security Number and fill out your business name and address.

- Check all applicable boxes on the form regarding business modifications and statuses.

- Complete Schedule A by transferring amounts from Schedule B as instructed.

- Fill in any necessary deduction or credit information, ensuring support documentation is attached.

- Review all completed sections of the form for accuracy and completeness.

- At this final step, you can save your changes, download the document for your records, print it for mailing, or share it if needed.

Begin completing your NY DTF NYC-202_DSA online today to ensure compliance and timely filing.

New York City and Yonkers have their own local income tax on top of the state tax. New York City income tax rates are 3.078%, 3.762%, 3.819% and 3.876%....New York state income tax rates and tax brackets. Tax rateTaxable income bracketTax owed4%$0 to $8,500.4% of taxable income.8 more rows • Mar 27, 2023

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.