Loading

Get Form Nyc-204ez - Unincorporated Business Tax Return For ...

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form Nyc-204ez - Unincorporated Business Tax Return online

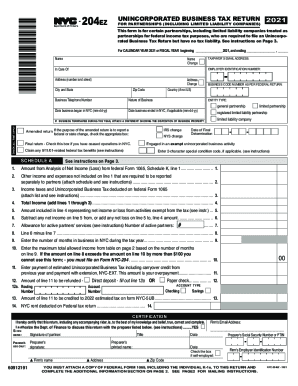

Filling out the Form Nyc-204ez is essential for partnerships, including limited liability companies, that have no tax liability yet need to report their business activities. This guide provides clear, step-by-step instructions to assist you in completing the form accurately online.

Follow the steps to complete your Unincorporated Business Tax Return online.

- Click ‘Get Form’ button to obtain the form and open it in your preferred online editor.

- Start by entering the required business information including the name, address, and taxpayer's email address. Make sure to input the Employer Identification Number correctly to ensure proper processing.

- Indicate the nature of your business and select the appropriate entity type from the options provided: general partnership, limited partnership, registered limited liability partnership, or limited liability company.

- If applicable, attach a statement detailing the disposition of business property should your business have terminated during the year. Check any relevant boxes regarding IRS or NYS changes.

- Complete Schedule A by reporting your net income or loss, other income, and relevant deductions as instructed. It is important to attach any relevant schedules or forms required.

- Certify your return by signing and entering the details in the certification section. If applicable, authorize the department of finance to discuss the return with your preparer.

- Review all entries for accuracy. After verifying the information is complete, you can save changes, download, or print the form for submission.

Complete your Unincorporated Business Tax Return online today to ensure compliance and accuracy.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Partnership Return; Description of Form IT-204. Used to report income, deductions, gains, losses and credits from the operation of a partnership. New York Corporate Partner's Schedule K-1. (The instructions are for the partner.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.