Loading

Get Ny Dtf It-182 2021-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NY DTF IT-182 online

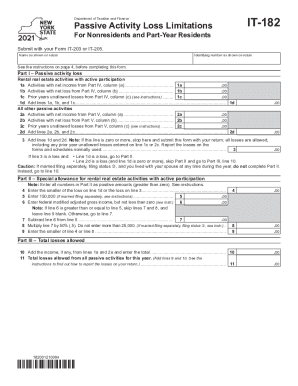

Filling out the NY DTF IT-182 form can seem challenging, but this guide provides clear instructions to help you navigate through each section. Whether you are a nonresident or part-year resident, understanding this form is crucial for accurately reporting your passive activity losses associated with New York sources.

Follow the steps to complete the NY DTF IT-182 online.

- Press the ‘Get Form’ button to access the form and open it in your preferred online editor.

- Fill in your name as shown on your tax return in the designated field.

- Proceed to Part I, where you will report your passive activity losses. Begin with rental activities by entering your net income on line 1a and losses on line 1b, as applicable.

- For all other passive activities, repeat the process: input net incomes and losses in Part I, lines 2a through 2d.

- If line 3 shows a loss, continue to Part II to calculate the special allowance for rental real estate activities with active participation. Enter the loss amounts as instructed, ensuring to skip lines as directed based on your filing status.

- In Parts IV through IX, document details of each rental activity and any related income, losses, and allowable deductions as required using the fields provided.

- Review the completed form for accuracy, making sure all necessary fields are filled out completely before submission.

Get started on completing your NY DTF IT-182 online to ensure accurate reporting of your passive activity losses.

The PTET is an optional tax that partnerships or New York S corporations may annually elect to pay on certain income for tax years beginning on or after January 1, 2021.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.