Loading

Get Pr Sc 2800 A 2015-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the PR SC 2800 A online

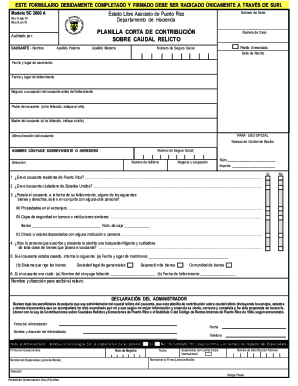

Completing the PR SC 2800 A form can be straightforward with the right guidance. This guide aims to provide clear, step-by-step instructions for users, enabling them to fill out the short contribution form for estate tax efficiently and accurately.

Follow the steps to fill out the PR SC 2800 A effectively.

- Press the ‘Get Form’ button to access the form and open it in your preferred editing tool.

- Begin by filling in the name of the deceased, referred to as the 'causante,' along with their serial number, and Puerto Rico's associated status.

- Provide personal details of the deceased including their last name, social security number, date and place of birth, as well as the date and place of death.

- Indicate the business or occupation of the deceased prior to their passing.

- If applicable, include information about the deceased’s parents, specifying if they have passed and the respective years.

- List the last address of the deceased and ensure that the receipt control number is accurately noted.

- Detail the particulars of the surviving spouse or heir, including their name, address, and phone number.

- Answer the yes/no questions regarding the residency and citizenship of the deceased.

- If the deceased owned foreign properties, bank safety deposit boxes, or had funds with institutions or individuals, provide the requested details.

- Declare if a diligent search was conducted for the deceased’s assets, ensuring accuracy in your claim.

- If the deceased was married, fill out the marriage details including the date and place, and specify the governing property system.

- In the Administrator’s Declaration section, provide the administrator's signature, date, and contact information.

- Make sure to include necessary documentation with the form, as specified in the instructions, including payment receipts and certifications.

- Once you have completed the form and included all required information, save your changes, and prepare to submit it either online or through a designated mailing address.

Start filling out the PR SC 2800 A online today to ensure a smooth processing of your document.

When you use rounded figures on your federal tax return, use them throughout on each form and schedule. Instead of making dollars-and-cents entries on your federal tax return, you may round off your entries into whole dollar amounts. ... Round amounts of less than 50 cents down to the next whole dollar.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.