Loading

Get Ny Dtf It-201 2021-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NY DTF IT-201 online

This guide provides a step-by-step approach to filling out the New York State DTF IT-201 income tax return form online. Designed for individuals looking to navigate the process with ease and confidence, our instructions prioritize clarity and accessibility.

Follow the steps to successfully complete your NY DTF IT-201 form.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

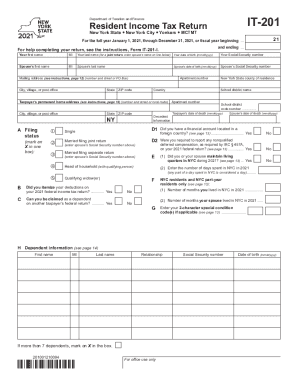

- Begin by entering your personal information in the designated fields. This includes your first name, middle initial, last name, date of birth, and Social Security number. If applicable, include your spouse’s information below.

- Complete your mailing address, ensuring all sections are filled out accurately. This includes your street address, city, state, and zip code.

- Indicate your filing status by marking an 'X' in the appropriate box, selecting from options such as single, married filing joint, married filing separate, head of household, or qualifying widow(er).

- Proceed to detail your financial information, including wages, salaries, and any other income in the corresponding fields. Include adjustments and subtractions as instructed.

- Complete the sections related to tax computation, credits, and any other applicable taxes. Be sure to add and subtract amounts as required to calculate your total New York State tax.

- Review and enter any refundable credits you qualify for in the specified fields. This may include child credits, dependent care credits, or others as listed.

- Finally, ensure that you complete the refund and payment sections. State your refund preference, if any, and provide relevant information for direct deposit or payment options.

- After filling in all required information, review your entries for accuracy. Save your changes, and you may download, print, or share your completed form.

Start filling out your NY DTF IT-201 form online today for a smooth tax filing experience.

The resident must use Form IT-201. The nonresident or part-year resident, if required to file a New York State return, must use Form IT-203. However, if you both choose to file a joint New York State return, use Form IT-201; both spouses' income will be taxed as full-year residents of New York State.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.