Loading

Get Irs 2220_dsa

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 2220_DSA online

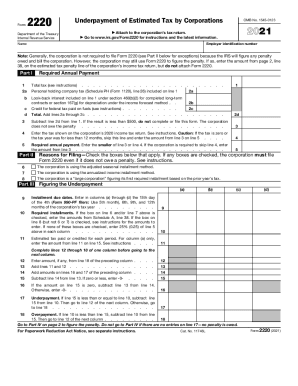

The IRS Form 2220_DSA is utilized for figuring the underpayment of estimated tax by corporations. Completing this form accurately is essential for ensuring compliance with tax regulations and avoiding potential penalties.

Follow the steps to complete the form effectively.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter the employer identification number and the name of the corporation at the top of the form.

- In Part I, calculate the required annual payment by filling in the total tax and personal holding company tax amounts as outlined in the instructions.

- Check the applicable reasons for filing in Part II. Ensure you mark any relevant boxes based on your corporation's situation.

- Move to Part III, where you will input installment due dates and required installments. Make sure to complete each column fully before moving to the next.

- If applicable, complete Part IV to figure the penalty for any underpayment, following the calculations provided.

- Review all entries for accuracy and completeness before saving. Once you are satisfied, save your changes, and you may download, print, or share the completed form as needed.

Start filling out the IRS 2220_DSA online to ensure compliance and avoid penalties.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

Go to .irs.gov/Form2220 for instructions and the latest information. Note: Generally, the corporation is not required to file Form 2220 (see Part II below for exceptions) because the IRS will figure any penalty owed and bill the corporation. However, the corporation may still use Form 2220 to figure the penalty.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.