Loading

Get Irs 5329_dsa

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 5329_DSA online

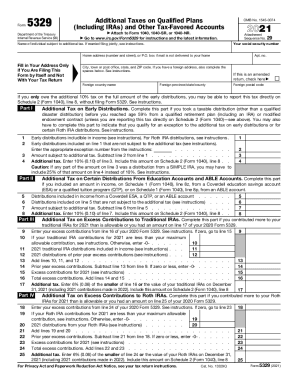

The IRS Form 5329 is used to report additional taxes on qualified plans, including IRAs and other tax-favored accounts. Completing this form online can help ensure that you accurately file your additional tax information with the IRS.

Follow the steps to complete the IRS 5329_DSA online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter your social security number in the designated field. Ensure that the number is accurate to avoid potential issues with your filing.

- Provide the name of the individual subject to the additional tax. If you are married and filing jointly, refer to the related instructions.

- Fill in your home address. If you are filing this form by itself and not alongside your tax return, use this section. Include the city, state, and ZIP code, and provide any necessary foreign address details if applicable.

- Indicate if this is an amended return by checking the appropriate box if necessary.

- Proceed to Part I. Complete the sections related to additional tax on early distributions. Enter the total early distributions and determine if any exceptions apply.

- Calculate the amount subject to additional tax by subtracting the line for distributions not subject to tax from the total early distributions. Then, calculate the additional tax amount.

- Continue to complete Parts II through IX based on your specific tax situations, including distribution accounts like Coverdell education savings accounts, traditional and Roth IRAs, health savings accounts, and any excess contributions.

- After filling out all relevant sections, review your entries for accuracy.

- Finally, save your changes, download a copy of the completed form, print it, or share it as needed before submitting.

Start filling out your IRS 5329_DSA online to ensure compliance and accuracy in your tax filing.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.