Loading

Get Irs 1120-l_dsa

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 1120-L_DSA online

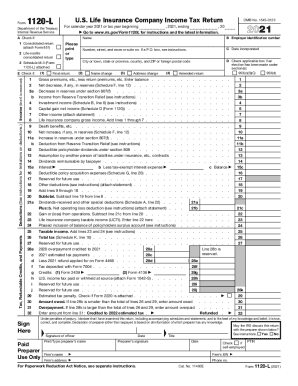

Filling out the IRS 1120-L_DSA form is an essential process for life insurance companies to report their income and expenses. This guide provides clear, step-by-step instructions to help users complete the form efficiently and correctly online.

Follow the steps to complete the IRS 1120-L_DSA online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Provide the employer identification number in section B, which identifies your corporation for tax purposes.

- Enter the date incorporated and the address of your corporation in section C, ensuring all information is accurate.

- In section D, check any applicable boxes if an election has been made under specified sections, such as for a name change or an amended return.

- Record the life insurance company gross income by adding all applicable income lines in section 1.

- Complete the deductions section, ensuring you detail any deductible policyholder dividends and claim other valid deductions in section 4.

- Calculate the taxable income by integrating calculated figures from the income and deductions sections, ensuring to follow the instructions for accuracy.

- Review all entered information for completeness and accuracy before saving your progress.

- After completing the entry, you may save changes, download, print, or share the form as needed.

Start completing your IRS 1120-L_DSA form online now for a smoother filing experience.

Based on the 1120 S instructions the PPP forgiveness amount is tax exempt income reported on M-2 OAA column d. This can only be done by putting the amount in the tax exempt interest line.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.