Loading

Get Irs 990 - Schedule F_dsa

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 990 - Schedule F_DSA online

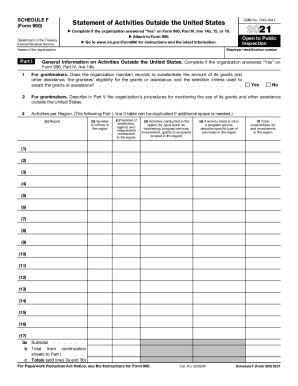

The IRS 990 - Schedule F_DSA is a crucial form for organizations operating outside the United States, especially if specific conditions were met in part IV of the main Form 990. This guide will provide you with clear, step-by-step instructions for effectively completing this form online.

Follow the steps to successfully complete the IRS 990 - Schedule F_DSA.

- Press the ‘Get Form’ button to access the IRS 990 - Schedule F_DSA and open it in your online editor.

- Begin with Part I, titled 'Statement of Activities Outside the United States.' If your organization has answered 'Yes' to the relevant parts of Form 990, complete this section by detailing your organization's activities in different regions outside the U.S. Use the provided table to fill in information such as region, number of offices, employees, activities conducted, and total expenditures.

- Move on to Part II, which requires information about grants and other assistance provided to organizations outside the U.S. For every recipient that received more than $5,000, provide details in the designated fields, including the name of the organization, purpose of the grant, and both cash and noncash assistance amounts.

- In Part III, input details regarding grants and assistance to individuals outside the United States. Similar to Part II, document the type of assistance, region, number of recipients, and amounts of both cash and noncash assistance.

- Proceed to Part IV, which includes yes/no questions regarding foreign transactions and interests. Respond appropriately to each query, as these may require additional forms to be filed.

- Finally, complete Part V, offering any required supplemental information as detailed in earlier parts of the form. This section is essential for additional context regarding monitoring of grants and any other relevant activities.

- Once all sections are filled out, review the entire document for accuracy. Save your changes, and you will have the options to download, print, or share the completed form as needed.

Start completing your IRS 990 - Schedule F_DSA online today for accurate and timely submission.

Unrealized gain or loss on investments may be grouped with “investment income” on the financial statements. Form 990 does not take into account unrealized gain or loss in arriving at total revenue, thus it is a reconciling item on Schedule D.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.