Loading

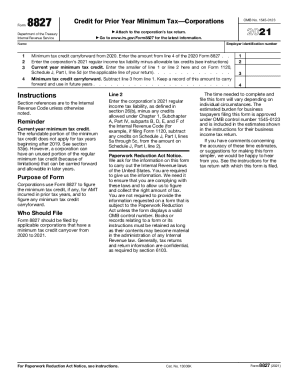

Get 2021 Form 8827. Credit For Prior Year Minimum Taxcorporations

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the 2021 Form 8827. Credit For Prior Year Minimum Tax Corporations online

Filling out the 2021 Form 8827, Credit For Prior Year Minimum Tax Corporations, is essential for applicable corporations that wish to claim a minimum tax credit. This guide offers a clear, step-by-step approach to assist you in completing this form accurately.

Follow the steps to effectively fill out your form.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering the employer identification number in the designated field at the top of the form.

- For line 1, enter the minimum tax credit carryforward amount from the 2020 Form 8827, specifically from line 4.

- Finally, calculate the minimum tax credit carryforward by subtracting the amount on line 3 from line 1. It is important to keep a record of this carryforward for future tax years.

Complete your documents online to ensure accurate filing.

Every corporation that is incorporated, registered, or doing business in California must pay the $800 minimum franchise tax.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.