Loading

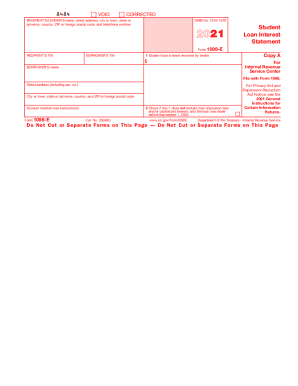

Get Irs 1098-e_dsa

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 1098-E_DSA online

Filling out the IRS 1098-E_DSA form online can be straightforward when you follow the right steps. This guide provides a comprehensive approach to help you accurately complete the form, ensuring you fulfill your requirements efficiently.

Follow the steps to navigate the IRS 1098-E_DSA form.

- Click ‘Get Form’ button to access the IRS 1098-E_DSA form and open it in your preferred online editor.

- Locate the section for the recipient's or lender's name and address. Enter the full name, street address, city or town, state or province, country, ZIP code or foreign postal code, and telephone number.

- In Box 1, input the total amount of student loan interest received by the lender during the year. Ensure this amount is accurate, as it will impact tax calculations.

- Provide the borrower's name and complete address, including apartment number if necessary.

- If there is an account number associated with the loan, include this in the designated field to maintain clarity in documentation.

- Review all entered information for accuracy and completeness to avoid potential penalties.

Start completing your IRS 1098-E_DSA form online today to ensure timely filing.

You'll have to wait until your return is either accepted or rejected. If rejected, you can make any necessary changes. If accepted, you'll need to amend your return. To avoid unnecessary delays, do not amend until your original return has been fully processed.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.