Loading

Get Ok Form 561nr 2021-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the OK Form 561NR online

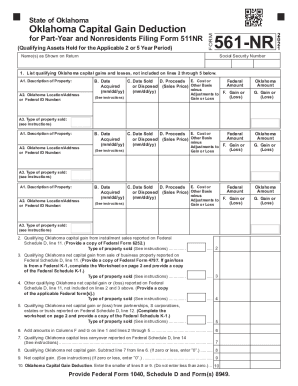

Filling out the OK Form 561NR online is essential for individuals who qualify for the Oklahoma capital gain deduction. This guide provides clear and supportive step-by-step instructions to assist users in completing the form accurately and efficiently.

Follow the steps to fill out the OK Form 561NR online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering your social security number at the top of the form. Follow this by listing your name as shown on your return.

- In the first section, list the qualifying Oklahoma capital gains and losses. For each entry, provide the description of property, location or Federal ID number, date acquired, date sold, proceeds from the sale, and cost or other basis.

- Proceed to indicate the type of property sold in the designated area, using the instructions as a guide to ensure accuracy.

- Continue filling out lines 2 through 5, providing qualifying capital gain information as indicated. Make sure to include any necessary Federal forms as required, such as Federal Form 6252 or 4797.

- Add the amounts in columns as instructed, paying close attention to detail to ensure all figures are accurate and properly totaled.

- For lines regarding capital loss carryovers, input data carefully and ensure all calculations reflect the correct Oklahoma amounts.

- Review the completed form thoroughly to confirm all fields are filled out correctly before saving your changes.

- Finally, you can save changes, download, print, or share the form as needed to submit your OK Form 561NR.

Start completing your OK Form 561NR online today to take advantage of potential capital gain deductions.

Related links form

2022 Form 561 Oklahoma Capital Gain Deduction for Residents Filing Form 511.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.