Loading

Get Canada Rc4288 2020-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Canada RC4288 online

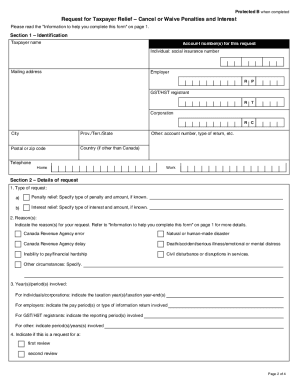

Filling out the Canada RC4288 form is an essential step for individuals and businesses seeking relief from penalties and interest related to their taxes. This guide will provide clear instructions on how to complete the form efficiently and accurately online.

Follow the steps to complete the Canada RC4288 form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by providing your personal information in Section 1. Enter your name, account number, mailing address, and contact numbers clearly.

- In Section 2, outline the details of your request. Specify if you are seeking penalty relief or interest relief and provide the corresponding amounts.

- Indicate the reasons for your request under the appropriate categories such as CRA error, financial hardship, or serious illness, among others.

- List the tax year or period related to your request to ensure clarity on which obligations you are addressing.

- If applicable, clarify whether this is a first or second review of your request by checking the appropriate box.

- Provide a detailed explanation of your circumstances that justify your request in the space provided. Attach additional sheets if necessary.

- In Section 3, certify that the information provided is accurate by signing the form with your name, title (if you are a representative), and the date.

- Finally, review the form for accuracy and completeness. You can then save your changes, download, print, or share the form as needed.

Complete your Canada RC4288 form online today for timely processing and resolution.

The reality is that, the CRA does not negotiate. It wants the money that is owed to it. No matter how good of a negotiator you are, the CRA will not lower the overall amount of tax debt that you owe. You owe this money and the CRA wants to receive it.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.