Loading

Get Ok 511tx 2021-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the OK 511TX online

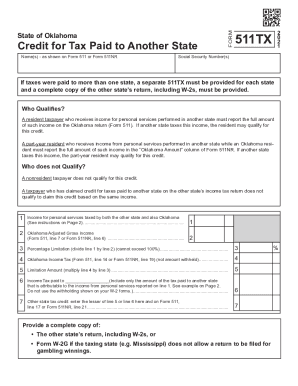

The OK 511TX form is essential for residents and part-year residents of Oklahoma who are seeking a credit for taxes paid to other states. This guide will provide you with clear, step-by-step instructions on how to complete this form online, ensuring a smooth filing process.

Follow the steps to effectively complete the OK 511TX form.

- Click 'Get Form' button to obtain the form and open it in your preferred editor.

- Enter your name(s) as shown on Form 511 or Form 511NR in the designated field. Ensure that this information matches your official tax documents.

- In line 1, report the total income for personal services that was taxed by both the other state and Oklahoma. Be sure to exclude any non-service income such as rental income or retirement benefits.

- Calculate the percentage limitation for line 3 by dividing the amount from line 1 by that from line 2. This percentage cannot exceed 100%.

- On line 5, determine the limitation amount by multiplying the income from line 4 by the percentage from line 3.

- On line 7, enter the lesser of the amounts from line 5 and line 6. This is the credit for tax paid to another state that you will report on Form 511 or Form 511NR.

- Before submitting, ensure you attach a complete copy of the other state's tax return, including W-2 forms, to your submission.

Complete your OK 511TX form online today to ensure you receive the tax credits you deserve.

Non-residents are also required to file a state income tax return when they receive gross income of at least $1,000 of Oklahoma source income.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.