Loading

Get Ok Otc Wth 10001 2021-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the OK OTC WTH 10001 online

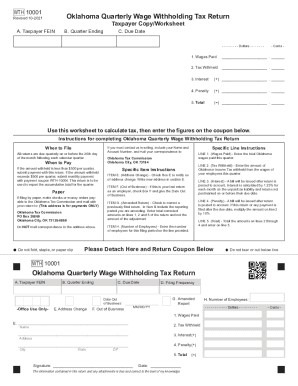

The Oklahoma Quarterly Wage Withholding Tax Return (OK OTC WTH 10001) is essential for employers to report withholding tax on employee wages. This guide will provide user-friendly, step-by-step instructions to help you complete the form accurately and efficiently.

Follow the steps to successfully complete the OK OTC WTH 10001 form.

- Press the ‘Get Form’ button to access the form. This will allow you to open the document in an editable format.

- Enter your Taxpayer FEIN in Section A. This is your Federal Employer Identification Number, which is necessary for identification purposes.

- In Section B, indicate the quarter ending date. Be sure to select the correct quarter that corresponds to the wages you are reporting.

- Fill out Section C with the due date for the form submission, which is the 20th day of the month following the end of the quarter.

- Complete Line 1 by entering the total amount of wages paid during the quarter. Ensure this figure reflects all employee wages.

- In Line 2, input the total amount of tax withheld from employee wages for the reported quarter.

- If applicable, calculate and enter any interest owed in Line 3. Standard interest is calculated at 1.25% per month on overdue balances.

- For Line 4, if there are any penalties incurred due to late filing, calculate 10% of the tax withheld amount from Line 2 and enter it here.

- Add the amounts from Lines 2 to 4 to get the total, and enter this figure in Line 5.

- If applicable, check Box E to notify about an address change, entering the new address accordingly.

- If this is your final return, check Box F and provide the date when your business ceased operations.

- To correct any previous submissions, check Box G and include the amended reporting period in Item B.

- Indicate the number of employees for this filing period in Item H.

- After completing all sections, review your entries for accuracy. Make any necessary adjustments.

- You can now save your changes, download the completed form, print it for physical submission, or share it as needed.

Complete the OK OTC WTH 10001 form online to ensure timely and accurate tax reporting.

Oklahoma Income Tax Withholding Oklahoma requires employers to withhold state income tax from their employees' wages and remit the amounts withheld to the Withholding Tax Division, Oklahoma Tax Commission.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.