Loading

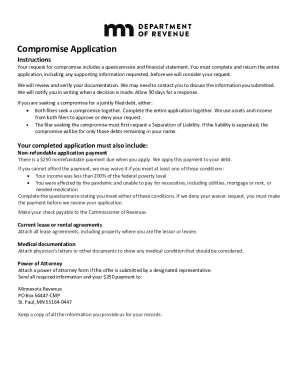

Get Requesting A Compromiseminnesota Department Of Revenue

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Requesting A Compromise Minnesota Department Of Revenue online

This guide provides clear instructions on how to complete the Requesting A Compromise form for the Minnesota Department Of Revenue online. By following these steps, users will be able to submit their application accurately and efficiently.

Follow the steps to successfully complete your compromise request.

- Click ‘Get Form’ button to obtain the form and open it in your preferred editor.

- Begin by filling out the Compromise Questionnaire with your personal information, including your name, Social Security number, and contact details. This will help evaluate your ability to pay.

- Proceed to answer the questions in the questionnaire thoroughly. Address each financial situation, such as maximum payments possible, income sources, and any real estate transactions.

- Complete the Individual Financial Statement by detailing all income, expenses, assets, and liabilities. Ensure accuracy and completeness to avoid denial of your request.

- Attach all required supporting documents, including lease agreements, medical documentation, and any power of attorney forms, as needed.

- Include the non-refundable application payment of $250. If you qualify for a waiver, fill out the necessary section on the form.

- Once all sections are complete, review your application for accuracy, save changes, and prepare to submit it.

- Send your completed application along with the payment to the designated address. Keep a copy of all documentation for your records.

Complete your Requesting A Compromise form online today to take the next step towards resolving your tax issues.

The Revenue Recapture program allows the Minnesota Department of Revenue to recapture (take) your individual tax refunds or other payments and apply them to debts we're collecting for other agencies or for the federal government. (See Minnesota Statutes, section 270A. 03 and section 270C. 41.)

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.