Loading

Get Irs 8854_dsa

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 8854_DSA online

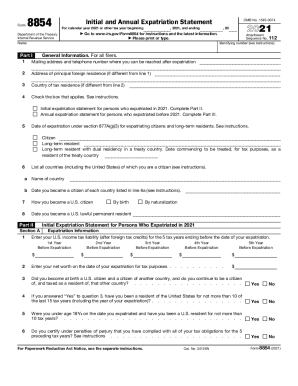

The IRS 8854_DSA, or Initial and Annual Expatriation Statement, is a crucial form for individuals who have expatriated from the United States. This guide provides clear, step-by-step instructions to assist users in completing the form online.

Follow the steps to successfully complete the IRS 8854_DSA online.

- Click the ‘Get Form’ button to download the form and open it in the appropriate editor.

- Begin by providing your name and identifying number in the designated fields. Ensure that all details are accurate, as these are crucial for identification purposes.

- Complete Part I, where you will enter your mailing address and contact information. This section ensures the IRS can reach you after your expatriation.

- Indicate your principal foreign residence and tax residency. This information is vital for determining your tax status.

- Check the appropriate box regarding whether this is an initial or annual expatriation statement. This determines which subsequent parts of the form you will complete.

- Fill in the date of your expatriation and your citizenship information. This helps clarify your expatriation status.

- Proceed to Part II, Section A to disclose your U.S. income tax liabilities and net worth, as these figures are essential for establishing your tax responsibilities.

- In Section B, create a balance sheet that lists your assets and liabilities as of your expatriation date to provide a comprehensive view of your financial status.

- If applicable, complete Section C, where you will report any property owned on your expatriation date, focusing on deferred compensation items.

- In Section D, indicate if you are opting to defer tax liabilities, outlining the specific tax amounts, which can significantly impact your financial obligations.

- Finally, review all sections for accuracy, make any necessary adjustments, and save your changes. Users can then download, print, or share the completed form as needed.

Start completing your IRS 8854_DSA online today to ensure compliance with expatriation requirements.

1. It's illegal. The law requires you to file every year that you have a filing requirement. The government can hit you with civil and even criminal penalties for failing to file your return.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.