Loading

Get Irs 990 - Schedule G_dsa

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 990 - Schedule G_DSA online

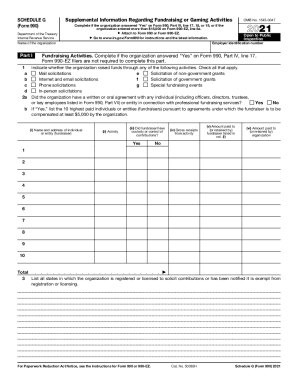

The IRS 990 - Schedule G_DSA is an essential document for organizations reporting their fundraising and gaming activities. This guide will provide clear and concise instructions for filling out the form online, ensuring you complete each section accurately.

Follow the steps to successfully complete the IRS 990 - Schedule G_DSA online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Review the introductory information provided at the top of the form, which outlines what the Schedule G_DSA encompasses and which organizations must complete it.

- Begin filling out Part I by indicating whether the organization engaged in fundraising activities. Check all activities that apply, such as mail solicitations or special fundraising events.

- Answer question 2 regarding any agreements with individuals or entities for fundraising services. If applicable, list the 10 highest paid fundraisers.

- Complete the section requesting the states where the organization is registered to solicit contributions.

- Move to Part II, where you will report direct expenses and gross receipts related to fundraising activities.

- In Part III, list any fundraising events that resulted in gross receipts greater than $5,000, detailing each event's income and expenses.

- For organizations involved in gaming, fill out the appropriate sections in Part IV, providing detailed information on gaming revenues and any related agreements.

- Provide any supplemental information as required, ensuring you reference prior parts of the form for explanations.

- Once all information is accurately filled in, save your changes and prepare to download, print, or share the completed form as needed.

Start completing your IRS 990 - Schedule G_DSA form online today!

Schedule G (Form 990) is used by an organization that files Form 990 or Form 990-EZ to report professional fundraising services, fundraising events, and gaming.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.