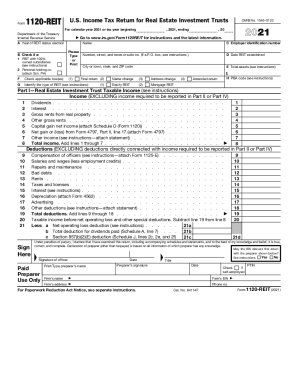

Get Www.irs.govpubirs-pdf2020 Instructions For Form 1120-reit - Internal Revenue Service

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the Www.irs.govpubirs-pdf2020 Instructions For Form 1120-REIT - Internal Revenue Service online

Filling out the Instructions for Form 1120-REIT can be an intricate process, but with a comprehensive guide, users can navigate it with ease. This document provides step-by-step instructions for completing the form online, ensuring a smooth filing experience.

Follow the steps to successfully complete your Form 1120-REIT online.

- Press the ‘Get Form’ button to obtain the form and display it in the editor.

- Begin by entering your name and employer identification number in the designated fields, ensuring accuracy.

- Fill in the date the REIT (Real Estate Investment Trust) was established.

- Check the appropriate box to identify the type of REIT you are filing for and denote the nature of the return (e.g., final return).

- Complete the deductions section by listing applicable expenses like officer compensation and salaries.

- Review sections for any required attachments and ensure all income sources reported match the instructions provided.

Complete your documents online today to ensure timely and accurate submissions.

0:24 2:20 Learn How to Fill the Form 1120 U.S. Corporation Income Tax Return YouTube Start of suggested clip End of suggested clip Taxes for the year first. Provide the name of the corporation. Along with contact information in theMoreTaxes for the year first. Provide the name of the corporation. Along with contact information in the top box of the form. Provide the employer identification number date of incorporation.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.