Loading

Get Irs 1099-c 2021-2026

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 1099-C online

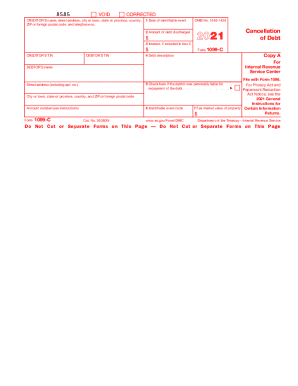

The IRS 1099-C form is used to report the cancellation of debt by a creditor. Completing this form accurately and submitting it on time is crucial for tax reporting purposes. This guide will help you navigate the online process of filling out the IRS 1099-C form, ensuring you understand each section.

Follow the steps to complete the IRS 1099-C form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter the creditor's name, street address, city or town, state or province, country, ZIP or foreign postal code, and telephone number in the designated fields at the top of the form.

- Input the debtor's name and address information in the corresponding sections, ensuring accurate entry of the street address, city or town, state or province, country, and ZIP or foreign postal code.

- Fill in the debtor’s taxpayer identification number (TIN) and the creditor's TIN where indicated, ensuring that all numbers are correct.

- In box 1, provide the date of the identifiable event, the date that marks when the debt was discharged or forgiven.

- In box 2, enter the amount of the debt discharged, reflecting the exact figure that was canceled by the creditor.

- If applicable, include any interest that was part of the discharged debt in box 3.

- Describe the nature of the debt in box 4, providing a clear summary that details what the debt was related to.

- Check box 5 if the debtor was personally liable for repayment of the debt.

- Identify the reason for the cancellation of the debt by entering the appropriate identifiable event code in box 6.

- If there was a foreclosure or abandonment connected with the cancellation of the debt, complete box 7 with the fair market value of the property.

- Once all fields are filled in correctly, review the entire form for accuracy. Save your changes, and consider downloading or printing a copy for your records.

Complete your IRS 1099-C form online today for accurate tax reporting.

It's unwise to ever ignore a canceled debt, or receipt of a 1099-C, especially since the IRS expects to have that specific income included within your return – unless there is an exclusion or exception. You should also track canceled debt, even if you didn't receive a 1099-C.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.