Loading

Get Irs 8833 2021-2026

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 8833 online

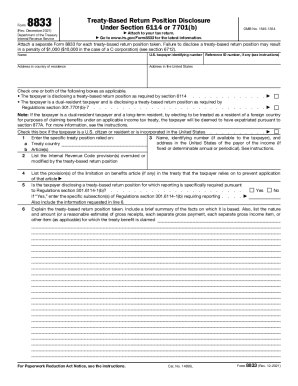

Filling out the IRS Form 8833 online can be a straightforward process if you understand its components and instructions. This guide provides step-by-step guidance to help users navigate the form and ensure accurate completion.

Follow the steps to fill out the IRS 8833 online efficiently.

- Press the ‘Get Form’ button to download the IRS Form 8833 and open it in your preferred editor.

- Enter your name and U.S. taxpayer identifying number in the respective fields.

- Provide your address in the country of residence, including city, province or state, and country, without abbreviating the country name.

- Input your U.S. address in the designated section.

- Check the appropriate box indicating whether you are disclosing a treaty-based return position under section 6114 or as a dual-resident taxpayer.

- On line 1, specify the exact treaty position you are relying on.

- On line 2, list the Internal Revenue Code provisions that are being overruled or modified by your treaty-based return position.

- Line 3 requires you to identify the payor's details if applicable – their name, identifying number, and U.S. address.

- On line 4, list the specific provision of the limitation on benefits article that you rely on.

- Answer the question on line 5 regarding whether the taxpayer is disclosing a position that requires specific reporting.

- Fill in line 6 with an explanation of the treaty-based return position taken, including details about the income affected, based on the information acquired.

- Once you have completed the form, save your changes, then download, print, or share the form as needed.

Complete your IRS 8833 form online for accurate and efficient submission.

Taxpayers use this form to make the treaty-based return position disclosure required by Internal Revenue Code section 6114. Dual-resident taxpayers use this form to make the treaty-based return position disclosure required by Regulations section 301.7701(b)-7.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.