Loading

Get Mo Dor Mo-96 2020-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MO DoR MO-96 online

Filling out the MO DoR MO-96 form online can streamline your tax reporting process. This guide will provide you with clear instructions on how to accurately complete each section of the form.

Follow the steps to complete the MO DoR MO-96 form online.

- Press the ‘Get Form’ button to access the MO DoR MO-96 form and open it in your editing tool.

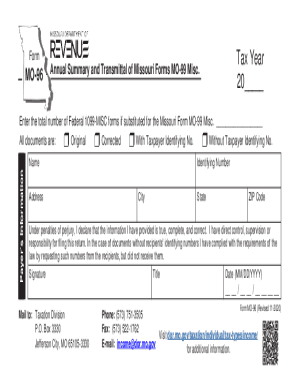

- In the 'Tax Year' section, enter the appropriate year for the tax return you are filing. This should be the year for which the related income documents are being reported.

- Locate the 'Form' section. Confirm that 'MO-96' is correctly listed for this submission, ensuring the form type matches your requirements.

- In the 'Enter the total number of Federal 1099-MISC forms' field, provide the count of Federal 1099-MISC forms being submitted if these are being substituted for Missouri Form MO-99 Misc.

- Next, complete the 'Payer’s Information' section. Fill in your name, identifying number, complete address, including state, city, and ZIP code.

- Select the appropriate option under 'All documents are' by marking one of the choices: Original, Corrected, With Taxpayer Identifying No., or Without Taxpayer Identifying No.

- Review the declaration statement regarding the truthfulness of the information provided. Your signature and title must be included here to verify your responsibility in filing this return.

- In the 'Mail to' section, ensure that the address for the Taxation Division is properly noted: P.O. Box 3330, Jefferson City, MO 65105-3330.

- Finally, fill in the date in MM/DD/YYYY format to confirm when you are completing this form.

- Once all sections are filled out, you can save your changes, download a copy of the form, print it for your records, or share it as needed.

Complete the MO DoR MO-96 form online today for a more efficient filing process.

Missouri requires 1099-Ks to be filed for each unique tax identification number with at least $1,200 USD in gross volume.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.