Loading

Get Ma Dor 3_dsa

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MA DoR 3_DSA online

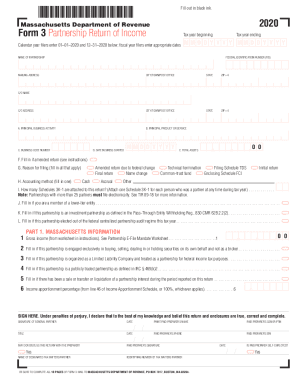

The MA Department of Revenue Form 3_DSA is essential for partnerships to report income in Massachusetts. This guide provides step-by-step instructions on how to effectively complete the form online, ensuring accuracy and compliance with tax regulations.

Follow the steps to complete the MA DoR 3_DSA form online.

- Click the ‘Get Form’ button to obtain the MA DoR 3_DSA and open it for editing.

- Enter the tax year beginning and ending dates. For calendar year filers, input '01-01-2020' and '12-31-2020'. For fiscal year filers, enter the appropriate starting and ending dates in MM DD YYYY format.

- Fill in the name of the partnership and the federal identification number (FID) in the designated fields.

- Complete the mailing address section, including the city/town/post office, state, and ZIP+4 code. If applicable, include a C/O address.

- Indicate the principal business activity and product or service offered by the partnership. Additionally, provide the corresponding business code number.

- Provide the date the business started in the format MM DD YYYY.

- Report the total assets of the partnership by filling out the relevant field.

- Indicate whether the return is amended by checking the appropriate box and provide a reason for filing if applicable.

- Choose the accounting method used (cash or accrual) by filling in one of the provided options.

- Indicate how many Schedules 3K-1 are attached to this return for each individual who was a partner at any time during the tax year.

- Complete any additional fields as necessary, including those related to audits, investment partnerships, and partnership elections.

- Finish by signing the form. The general partner must sign and date it, along with other required information for the paid preparer, if applicable.

- Review your entries for accuracy, then save changes, download, print, or share the completed form as needed.

Ensure your MA DoR 3_DSA is completed accurately by following these steps and submit your documents online.

To check the status of your tax refund by phone, call 1-617-887-6367 or toll-free in Massachusetts 1-800-392-6089 and follow the automated prompts. Generally, if your return has been completed correctly, electronically filed (e-filed) returns take up to six weeks to process. Paper returns take up to 10 weeks.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.