Loading

Get Nm Trd Rpd-41301_dsa

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NM TRD RPD-41301_DSA online

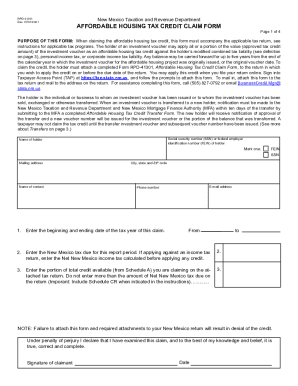

Filling out the NM TRD RPD-41301_DSA, or the Affordable Housing Tax Credit Claim Form, is an essential process for individuals and businesses claiming tax credits related to affordable housing investments in New Mexico. This guide provides clear, step-by-step instructions to help users complete this form accurately and efficiently online.

Follow the steps to properly fill out the NM TRD RPD-41301_DSA.

- Press the ‘Get Form’ button to acquire the NM TRD RPD-41301_DSA form and open it in your browser.

- Enter the holder's name, Social Security Number (SSN) or Federal Employer Identification Number (FEIN), mailing address, name of contact, email address, and phone number in the appropriate fields.

- For Line 1, indicate the beginning and ending dates of the tax year for which you are claiming the tax credit.

- In Line 2, enter the total New Mexico tax due for the reporting period. If this credit applies to an income tax return, provide the Net New Mexico income tax calculated before applying any credits.

- Line 3 requires you to enter the portion of total credit available (referencing Schedule A) that you are claiming on the attached tax return. Ensure that this amount does not exceed the Net New Mexico tax due on your return.

- Attach Schedule A to your claim, detailing all approved investment vouchers. Complete each column, providing the investment voucher number, issue date, amount of credit approved, total credits claimed in previous tax years, unused credits, and the amount being applied to the attached return.

- Review the entire form for accuracy. Under penalty of perjury, sign and date the form to affirm that the information provided is true and correct.

- Once completed, you can save your changes, download, print, or share the form as required to file your claim appropriately.

Complete your NM TRD RPD-41301_DSA form online for a smooth and efficient filing process.

A second bill passed during the April 2022 special session, giving $500 or $1,000 to any New Mexican who filed taxes, regardless of income. This year, the latest round of $750 or $1,500 payments is expected to go to as many as 875,000 New Mexico taxpayers in the summer.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.