Loading

Get Nm Trd Rpd-41227_dsa

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NM TRD RPD-41227_DSA online

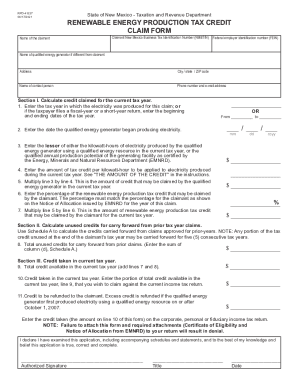

Filling out the NM TRD RPD-41227_DSA form, which is essential for claiming the renewable energy production tax credit, can seem daunting. This guide provides step-by-step instructions to assist users in accurately completing the form online.

Follow the steps to complete your tax credit claim form successfully.

- Press the ‘Get Form’ button to obtain the form and open it in the online editor.

- Enter the name of the claimant in the designated field at the top of the form.

- Provide the State of New Mexico Business Tax Identification Number (NMBTIN) and the Federal Employer Identification Number (FEIN) in the appropriate fields.

- If applicable, enter the name of the qualified energy generator if it differs from the claimant name.

- Fill in the claimant's address, including city, state, and ZIP code.

- Enter the name and contact details of the person responsible for the application, including phone number and email address.

- Proceed to Section I and calculate the credit claimed for the current tax year. Enter the tax year when the electricity was produced, or the fiscal year dates if necessary.

- Record the date when the qualified energy generator began producing electricity.

- In subsection three, enter the lesser of the kilowatt-hours of electricity produced or the qualified annual production potential certified by the EMNRD.

- Provide the amount of tax credit per kilowatt-hour to be applied based on the current year's production.

- Multiply the values from line 3 and line 4 to find the total credit amount claimable.

- Fill in the percentage of the renewable energy production tax credit based on the Notice of Allocation from EMNRD.

- Calculate the final amount of the renewable energy production tax credit by multiplying line 5 by line 6.

- Continue to Section II to calculate any unused credits from prior claims, using Schedule A as needed.

- In Section III, summarize the total credit available for the current year and specify the amount you wish to claim.

- Indicate the total amount of credit to be refunded, if applicable, and make sure to include this information on the relevant tax returns.

- Finally, declare and sign the form with your title and the date before submission.

Complete your NM TRD RPD-41227_DSA form online today to ensure you claim your renewable energy production tax credit.

Related links form

The State of New Mexico requires pass-through entities (which may be a state law partnership or a limited liability company taxed as a partnership) to withhold tax at 5.9% on earnings of non-resident partners or members if the owner's distributive share of net income is over $100 in a year.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.