Loading

Get Form It-613 Claim For Environmental Remediation Insurance Credit Tax Year 2021

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form IT-613 Claim For Environmental Remediation Insurance Credit Tax Year 2021 online

Filling out the Form IT-613 Claim For Environmental Remediation Insurance Credit for Tax Year 2021 is an essential step for individuals and organizations seeking to claim tax credits related to environmental remediation efforts. This guide will provide a clear and comprehensive overview of the steps required to complete the form online.

Follow the steps to properly complete the form online.

- Click ‘Get Form’ button to obtain the form and open it in an editor.

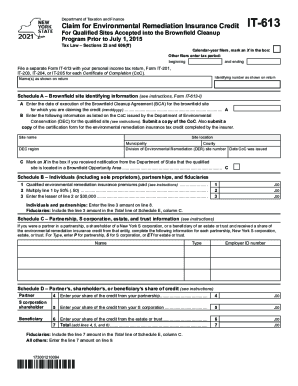

- Begin by marking an X in the box if you are a calendar-year filer. If you are filing for a different tax period, enter the beginning and ending dates.

- On the form, enter your name(s) as shown on your return, and provide the identifying number as indicated on your return.

- In Schedule A, provide the brownfield site identifying information. Start with the date of execution of the Brownfield Cleanup Agreement (BCA). Ensure to enter the date in the format mmddyyyy.

- Next, enter the site name, site location, DEC region, municipality, county, and Division of Environmental Remediation (DER) site number. Include the date the Certificate of Completion (CoC) was issued.

- Mark the appropriate box to indicate if you received notification from the Department of State that the qualified site is located in a Brownfield Opportunity Area.

- Proceed to Schedule B and enter the qualified environmental remediation insurance premiums paid. Multiply the total by 50% and enter the result in the corresponding line.

- Enter the lesser amount between the calculation in the previous step or $30,000 on the next line.

- Individuals and partnerships should enter the line amount from Schedule B on line 8. Fiduciaries must include this amount in the Total line of Schedule E, column C.

- In Schedule C, provide details for partnerships, S corporations, estates, and trusts that contributed to your credit claim. Enter the name, type, and employer ID number as required.

- In Schedule D, verify your share of the credit from the aforementioned entities and enter the amounts accordingly.

- Schedule E requires you to enter the beneficiary name, identifying number, and share of environmental remediation insurance credit. Sum the total amounts in this section.

- In Schedule F, compile your environmental remediation insurance credit amounts from the previous schedules. Ensure that you calculate any necessary totals.

- Finally, in Schedule G, summarize any recaptured environmental remediation insurance credit. Follow the instructions to ensure that amounts are allocated correctly.

- Once all information is filled out, save your changes, download the completed form, and prepare for submission.

Complete your Form IT-613 online today to ensure you maximize your environmental remediation insurance credit.

The goal of remediation is to identify, based on course instructional objectives and evidenced by poor performance on examination(s), areas of weaknesses of material, and, once identified, to assist the student in overcoming those weaknesses and develop mastery of the material.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.