Loading

Get Form Cift 620

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form Cift 620 online

This guide provides step-by-step instructions on how to fill out the Form Cift 620 online. Whether you are a first-time user or need a refresher, this comprehensive overview will support you in successfully completing this important tax form.

Follow the steps to complete your Form Cift 620 online.

- Click the ‘Get Form’ button to obtain the form and open it in your preferred online tool.

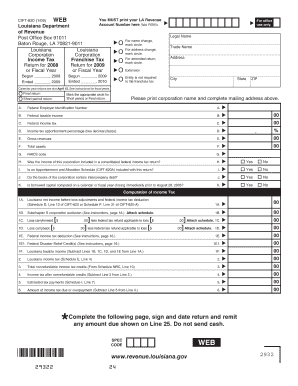

- Fill in your Louisiana Revenue Account Number at the top of the form. Ensure that this number is accurate to avoid processing delays.

- Provide the legal name of your corporation. If there are any changes in your name or address, mark the appropriate circle indicating a name change or address change.

- Indicate whether this is an amended return, an extension, or if your entity is not required to file franchise tax by marking the corresponding circles.

- Complete the sections for Federal Employer Identification Number, federal taxable income, federal income tax, and gross revenues, ensuring all values are accurate and aligned with your financial records.

- Proceed to fill out the computation of income tax section accurately, subtracting and adding values as indicated to arrive at your Louisiana taxable income.

- Continue with the computation of franchise tax, completing sections as required, including the assessment of total assets and nonrefundable tax credits.

- Review all sections for completeness and accuracy, making sure to attach any required schedules that accompany the form.

- Finally, save your changes, then download, print, or share the completed form as needed.

Complete your Form Cift 620 online today to ensure timely submission and compliance with Louisiana tax requirements.

FOREIGN CORPORATIONS – Corporations organized under the laws of a state other than Louisiana that derive income from Louisiana sources must file an income tax return (Form CIFT-620), whether or not there is any tax liability.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.