Loading

Get Tx Hcad Supplemental Abatement Application Questionnaire For Tax Year 2021

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the TX HCAD Supplemental Abatement Application Questionnaire For Tax Year online

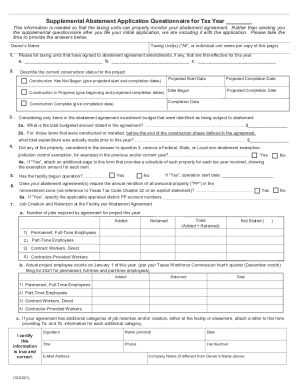

Filling out the TX HCAD Supplemental Abatement Application Questionnaire is a crucial step to ensure that your abatement agreement is properly monitored by taxing units. This guide will walk you through the process of completing the questionnaire online with clear and supportive instructions tailored to your needs.

Follow the steps to successfully complete the questionnaire online.

- Click ‘Get Form’ button to obtain the form and open it in your browser.

- Begin by entering the owner's name in the designated fields. Ensure that you use the full legal name as it appears in official documents.

- Next, specify the taxing unit or units that have agreed to the abatement agreement amendments. You can either select 'All' or list the individual unit names as required.

- Describe the current construction status of your project by selecting the appropriate status and providing the projected start and completion dates or actual dates where applicable.

- In section 3, provide the total budgeted amount stated in the abatement agreement, as well as the total expenditure made for items in that agreement prior to this year.

- Answer question 4 regarding any non-abatement exemptions. If applicable, attach the additional page with the required schedule of such property.

- Indicate whether your abatement agreement requires the annual rendition of all personal property in the reinvestment zone. If the answer is 'Yes', specify the applicable appraisal district personal property account numbers.

- Detail job creation and retention numbers as per your abatement agreement, filling in the numbers for added and retained jobs across various categories.

- If your agreement includes additional categories for job retention or creation, attach a letter providing the relevant information for each category.

- Finally, review all the filled sections for accuracy, sign the form, and provide your printed name, date, title, phone number, fax number, email address, and company name if it differs from the owner's name.

- After completing the form, remember to save your changes. You may choose to download, print, or share the completed questionnaire as needed.

Start filling out your TX HCAD Supplemental Abatement Application Questionnaire online today to ensure timely processing.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

PROPERTY TAX DEFERRALS Obtain the tax deferral affidavit from the appraisal district; Complete the form, have it notarized, and return it to the district; and. Pay the current taxes on all but the value over the 5% increase before the delinquency date. The delinquency date is January 31st of each year.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.